44 lump sum severance and unemployment

My unemployment claim was denied (actually, it was approved, 1 wait week completed, and 1 week paid, which they now want me to pay back) due to a lump sum severance pay, which I have not yet received (will be paid on the last day of the month consistent with pay period). I provided information to ODJFS when filing my claim that severance would ... Is a severance package considered wages? Under California law, severance pay is not considered wages for unemployment purposes. Instead, it is considered a payment in recognition of your past service. Is it better to have severance paid in a lump sum? Lump sum amounts are great if they best meet your financial needs after job loss. There are ...

Lump Sum Versus Continuing Payments If the employer makes a lump sum severance payment to a worker at the time the worker is separated from employment, and allocates that severance payment to a week or weeks other than the week in which the payment is made, then the worker's unemployment benefits

Lump sum severance and unemployment

The lump sum is properly considered severance pay under Section 8-1009 and not a pension, annuity, retirement or retired pay under Section 8-1008. However, the UI office can consider the severance as income ("wages") for 12 weeks before starting your unemployment ins. benefits. And they obviously have. This is not uncommon among the states. The idea is that the severance pay is replacing earned wages for a period of time; the fact that it is paid in a lump sum is irrelevant. Lump-Sum Payment vs. Weekly Payments. If severance is distributed as a lump sum, it will only affect unemployment for the week it was received. If severance is distributed in weekly, biweekly or monthly payments, it will affect unemployment each week it is received. If you plan to file a claim for unemployment benefits, a lump-sum severance ...

Lump sum severance and unemployment. I f an employer makes a lump sum severance payment at the time the worker is separated from a job but allocates the severance payment to a week or weeks other than the week in which the payment is made, then the worker’s weekly unemployment benefits will be reduced in each claimed week to which the severance payment is …. Is severance pay subject to California SDI? As long as severance is paid in a lump sum, is intended to recognize past years of service, or does not otherwise extend a persons employment, it should not affect eligibility for NJ unemployment. Unemployment benefits will not be paid until after the severance pay runs out. A severance package provides you with extra income in the form of a lump sum or a weekly payout to help tide you over while you search for another job. Though unemployment insurance is a federal program, each state makes its own rules for qualifying for benefits. Severance and Unemployment ODJFS treats severance differently depending on how it pays out. If you receive a lump sum and your employer doesn't assign that pay to a specific week, the payment reduces your unemployment check only for the week in which you receive the money.

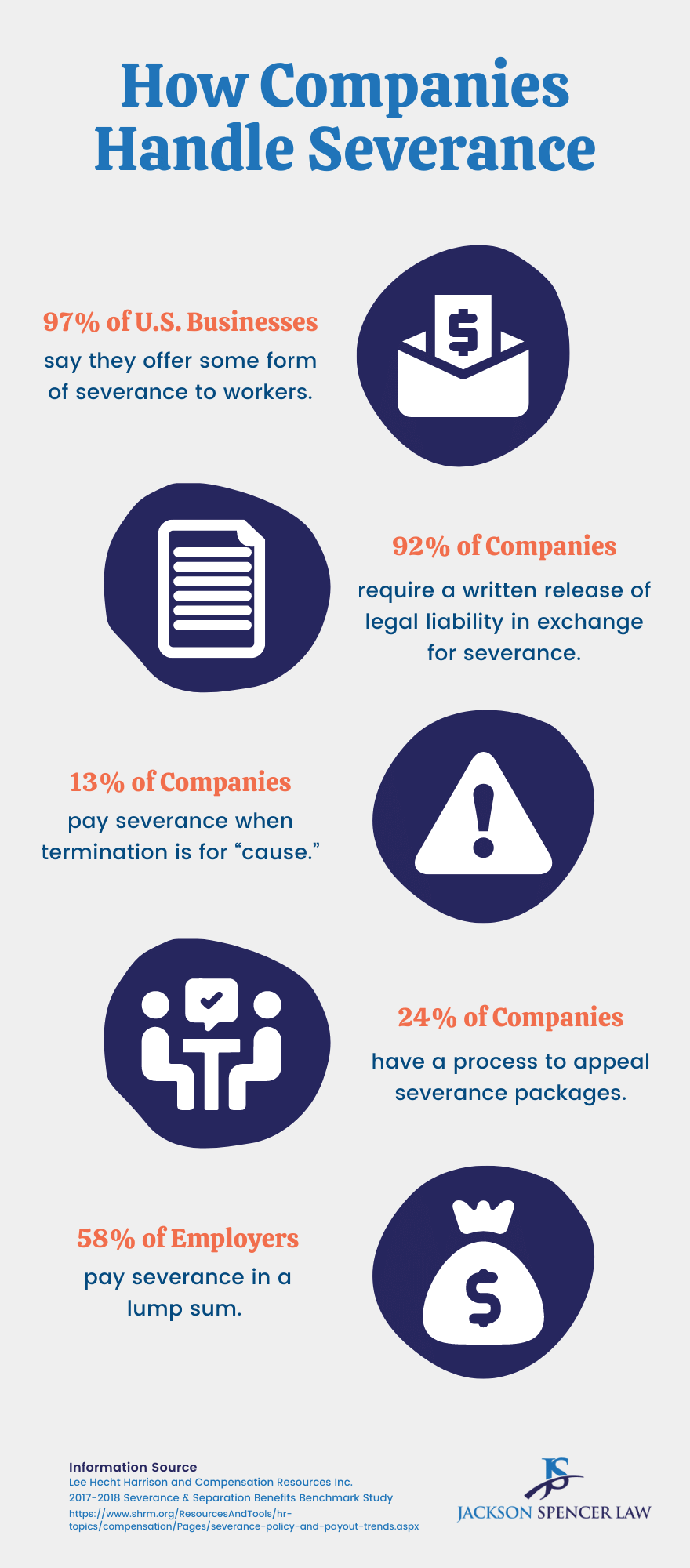

In contrast, an agreement by an employee to take a lump-sum payment upon separation in return for the employee's release of claims against the employer will not constitute the kind of payment that disqualifies the employee from receiving UI concurrently with the severance payment. White v. Commissioner of the Dep't of Employment & Training In the State of Florida, if you are paid severance for a number of weeks in a one lump sum, are you allowed to collect unemployment or do you have to wait until the severance weeks are depleted? I was laid off due to a reduction in workforce. My employer offered a severance agreement of 9 weeks payable in one lump sum. This meant some staff members received severance pay as low as $600. If an employee receives severance pay in a lump sum, it can help them receive their full unemployment compensation. The week the lump sum is received, unemployment payments are reduced for that one week and then return to normal. Weekly severance can limit unemployment. When you are laid off from a job and receive a severance package, it can impact your unemployment benefits. Severance is typically a lump-sum or regular payment given to employees by some companies when they terminate employment. Generally speaking, employers are not legally required to give severance pay, even after a layoff.

Severance pay generally does not include payments regarding retirement, health insurance, accrued leave, or unemployment benefits. The law recognizes that severance pay can be paid in several payments or one lump sum. And now the timing of the payment(s) matters for unemployment purposes. Why Timing Matters However, if an employer waits to start paying its former employee severance until after 30 days from his or her termination, then the severance payments will likely have no effect on the employee's eligibility for unemployment. Payment of a lump sum severance does not change the analysis because Section 591(6)(c) instructs that it should be ... The severance payment, like any other kind of remuneration," will reduce unemployment benefits for the weeks to which the severance payment is allocated or distributed. … amount, the unemployed worker is not entitled to any unemployment benefits for the week or weeks. Tip #2: Consider a lump sum severance pay and unemployment package; Tip #3: No one has to accept the first offer; Here is an article on severance package negotiation. Employee Separation Agreements. Florida employee separation agreements previously establish whether severance is payable upon meeting specific conditions.

If they receive a lump sum severance payment, then the Department of Labor will determine how many weeks of salary would be covered by the severance payment, and the claimant will be disqualified for that time frame.

Yes. Your severance payments come in several payments or in one lump- sum. As long as you no longer work for your employer, you qualify for unemployment benefits. If you continue to work, then the severance pay may be considered wages. If so, the pay can can prevent you from getting unemployment benefits or lower your benefit the amount.

If an employer pays severance pay in a lump sum, the Ohio Department of Jobs and Family Services (ODJFS) can allocate the lump sum severance payment to the period of unemployment that it covers and reduce unemployment compensation benefits for those weeks. Unemployment Compensation Eligibility and Benefit

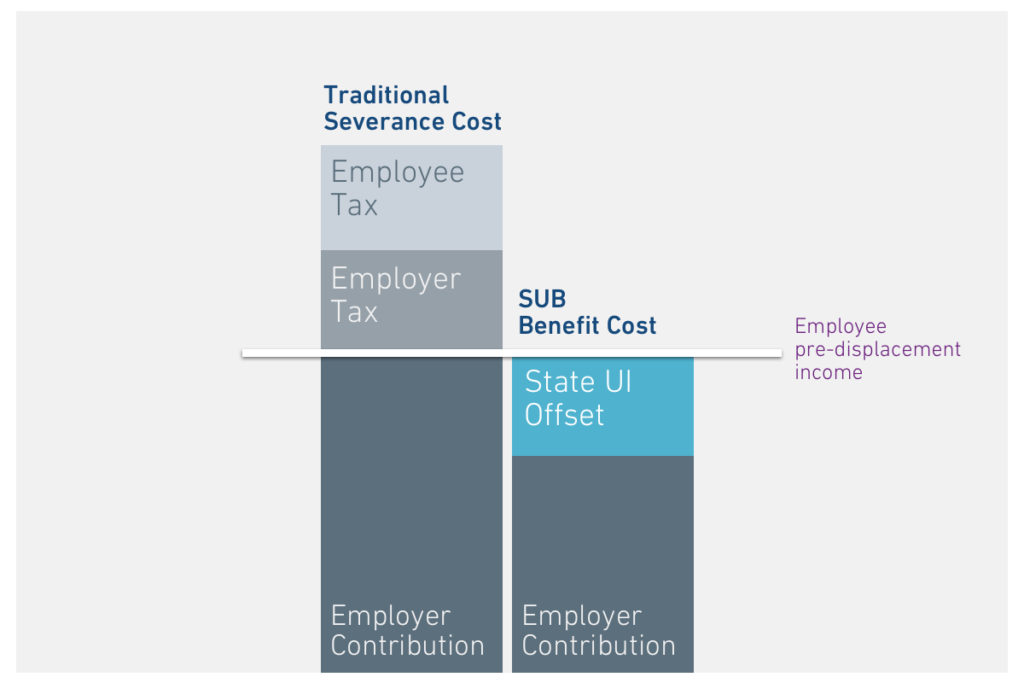

Severance paid to employees in a lump sum, unrelated to state unemployment benefits, is taxable as wages for both income-tax withholding and FICA purposes. Using the aggregate method, the employer would add the supplemental wages to regular wages and calculate the total amount as regular wages.

NJ Unemployment Insurance and Lump Sum Severance, Unemployment, 2 replies Lump-sum severance and unemployment in NY, Unemployment, 1 replies Ohio - lump sum severance and filing for UI benefits, Unemployment, 8 replies All times are GMT -6. The time now is 06:12 AM.

Even if severance is paid as a lump sum without reference to "months" or "weeks", Service Canada will examine your severance lump sum and divide it by your normal monthly earnings minus deductions etc. at the job you were let go from to determine how many "months" or "weeks" of severance you received.

The type of payment received will also have an impact on the unemployment benefits. Severance payments made to an employee in exchange for a release of claims ...

Separation, severance, or bonus payments that delay unemployment benefits. (a) An applicant is not eligible to receive unemployment benefits for any week the applicant is receiving, has received, or will receive separation pay, severance pay, bonus pay, or any other payments paid by an employer because of, upon, or after separation from employment.

Most employers designate any post-employment wages paid to ex-employees as severance pay. · For purposes of unemployment compensation, however, it is important ...

With a lump sum payment, you may be entitled to unemployment benefits after you've received that money. Severance that's paid in installments, however, could compromise your ability to collect...

Your employer will pay your severance pay in one of the following ways: as a lump-sum payment as a salary continuance, that is, where your regular pay and benefits continue for a limited time after you lose your job as deferred payments, that is, where your severance pay is paid to you over several years

Therefore, the lump-sum payments are severance or dismissal payments made according to a plan for the benefit of the officers, and thus come within the provisions of Section 1265. Because Section 1265 applies, these payments are not deductible wages, and the claimants are not ineligible for benefits because of receipt of these payments.

Unemployment benefits have nothing to do with severance payments - severance is a lump sum payment that covers the period from when you would have been let go and when you were actually let go.

No. Any dismissal/severance pay you receive within 30 days of your last day of employment, whether as a lump sum or in payments made to you over a period of time, may affect your benefits under UI reform. Usually, the time period covered by the lump sum payment will be clearly spelled out in your dismissal/ severance pay agreement or plan.

Lump-Sum Payment vs. Weekly Payments. If severance is distributed as a lump sum, it will only affect unemployment for the week it was received. If severance is distributed in weekly, biweekly or monthly payments, it will affect unemployment each week it is received. If you plan to file a claim for unemployment benefits, a lump-sum severance ...

However, the UI office can consider the severance as income ("wages") for 12 weeks before starting your unemployment ins. benefits. And they obviously have. This is not uncommon among the states. The idea is that the severance pay is replacing earned wages for a period of time; the fact that it is paid in a lump sum is irrelevant.

The lump sum is properly considered severance pay under Section 8-1009 and not a pension, annuity, retirement or retired pay under Section 8-1008.

![PDF] Lump-sum severance grants and the duration of ...](https://d3i71xaburhd42.cloudfront.net/6201e6df99009f2cbba4da9a5b9c7f39840bae84/22-Table1-1.png)

:max_bytes(150000):strip_icc()/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

/image%2F6366480%2F20210216%2Fob_b6cf37_nadra-divorce-certificate.png)

.png?width=763&name=High%20Quality%20(31).png)

/termination-4add4ada1fb543b790ad41a1df095344.jpg)

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/RIGVF2GPEREGFOSKWA6ZCFGH6E.jpg)

0 Response to "44 lump sum severance and unemployment"

Post a Comment